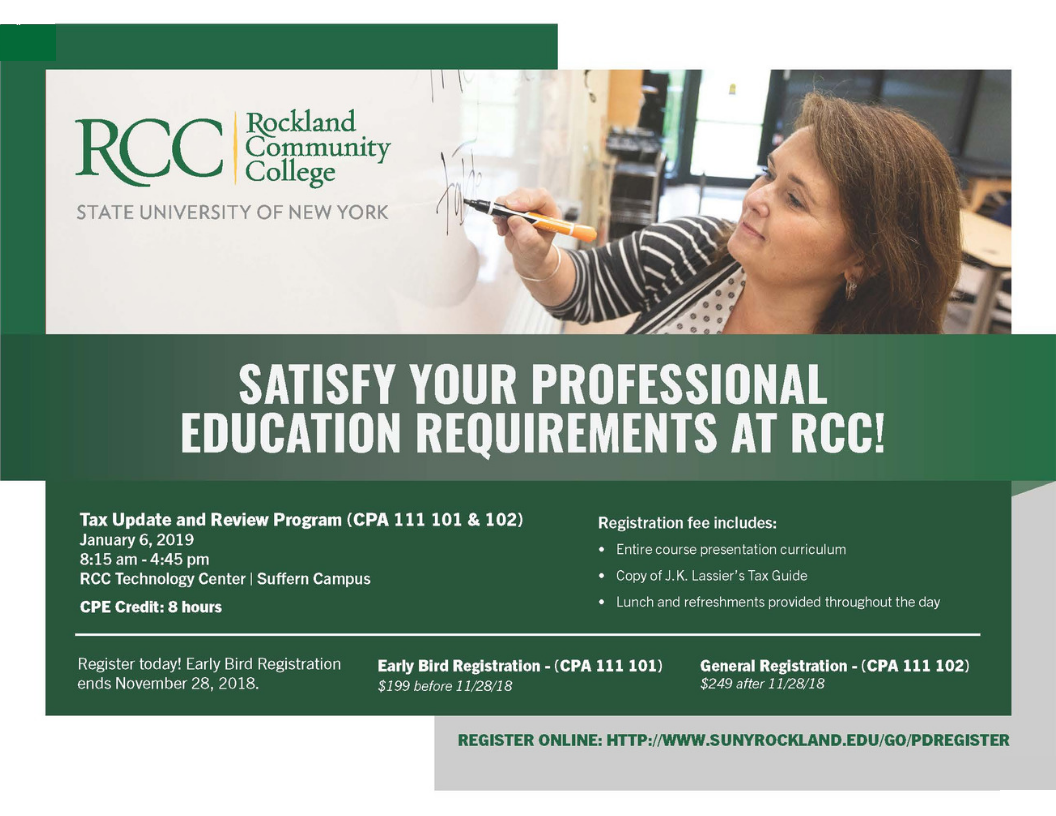

Professionals who deal in tax law can get updated on the latest developments in their field with a one-day seminar on January 6, 2019, at Rockland Community College. The seminar satisfies the professional education requirements in New York and New Jersey for licensees engaged in the practice of public accounting. Successful completion of the course earns 8 hours of CPE credit.

The session is led by Raymond G. Russolillo, CPA/PFS, CFP, a partner in the accounting and advisory firm of Withum Smith & Brown, PC.

Tax Update and Review

Sunday, January 6, 2019

8:15 am – 4:45 pm

Technology Center, Ellipse

Early bird registration (course number CPA 111 101) fee is $199 and ends on November 28. After that date, the general registration fee (course number CPA 111 102) is $249. Registration fee includes lunch, refreshments, a complete outline of Mr. Russolillo's presentation, and a copy of J.K. Lasser's tax guide, Your Income Tax 2019. For more information, please call 845-574-4151, or register online at www.sunyrockland.edu/go/pdregister.

Facebook Comments