OneClass, the online company best known for its business model where students can buy and sell class and textbook notes, sent us numerous infographics pertaining to student debt and how students can get out of it.

Of course, one of these suggestions is to work for OneClass, but even with that shameless plug, the list is legit and useful, so we thought we’d share their findings here. You can see all of the infographics below. Let’s go:

The Problem

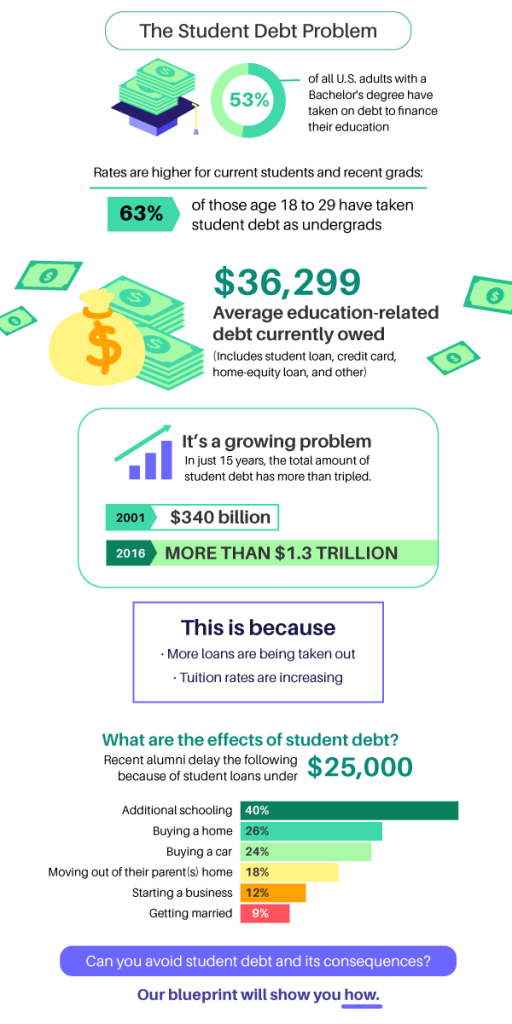

First, let’s look at how student debt is ruining a generation. Whereas debt was a mere $340 billion problem in 2001, it’s now over $1.3 TRILLION.

The average student borrower racks up $36,299 in debt. Sixty-three percent of 18-29 year olds have some student debt. Because of this, 40% delay going for additional schooling (no master’s degree, for example), and about a quarter put off buying a house or car. Eighteen percent have to live at home with parents because of student debt. Some student debtors avoid starting a business, or even getting married.

The Solutions

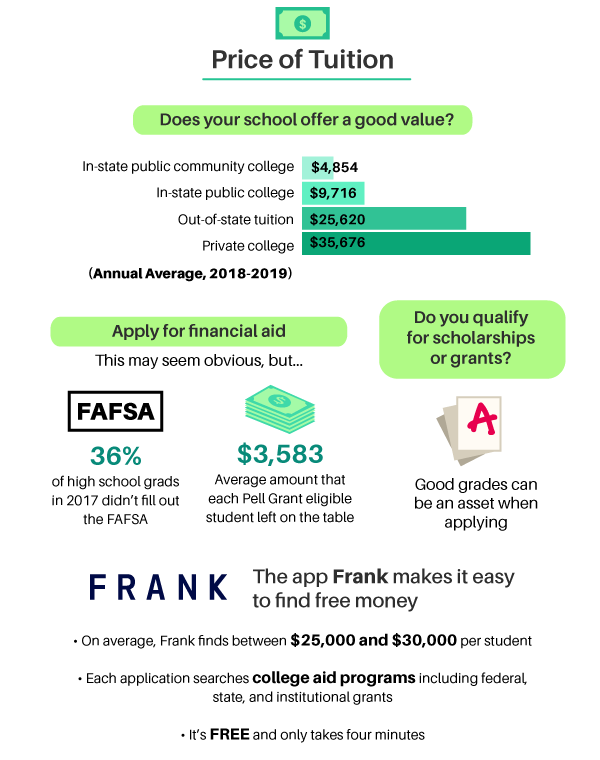

Fill out your FAFSA. Thirty-six percent of students don’t and leave approximately $3600 on the table.

Get good grades. You may be able to get grade-related grants your sophomore or junior years. Ask your Financial Aid office about this.

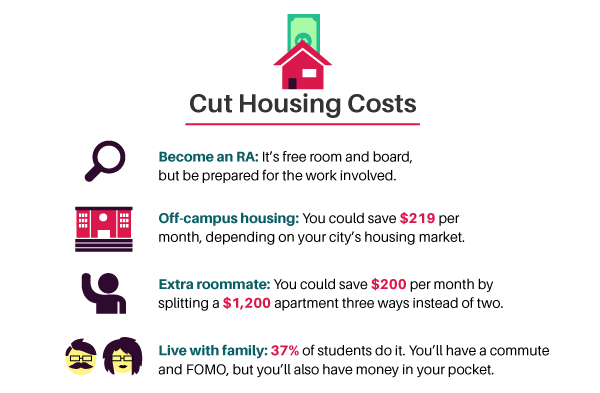

Cut housing costs. Become an RA for free room and board. Or move off campus – the typical student who gets roomies and a lease saves $219 a month. Or live with family – 37% of college students do.

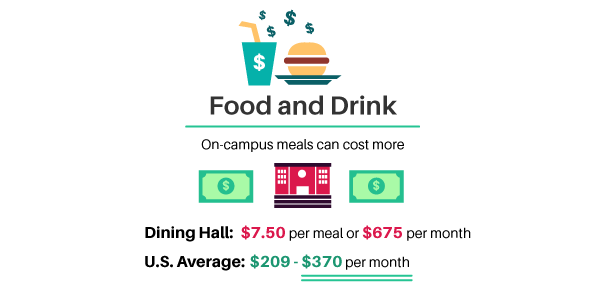

Skip the dining hall. With the typical meal costing $7.50, you can save $675 a month converting to homemade peanut butter and jelly.

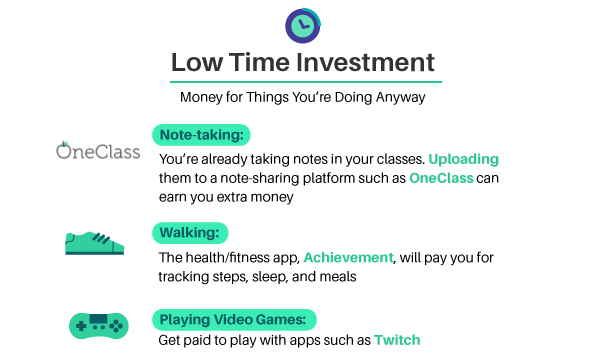

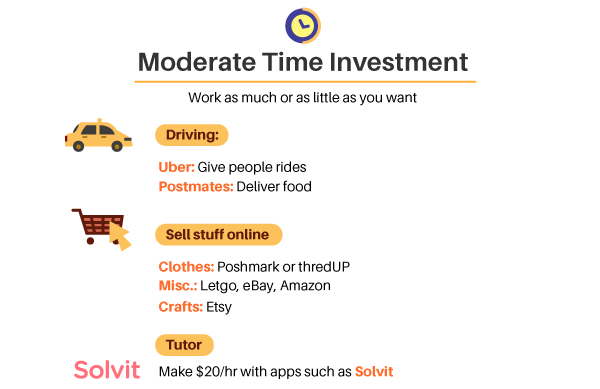

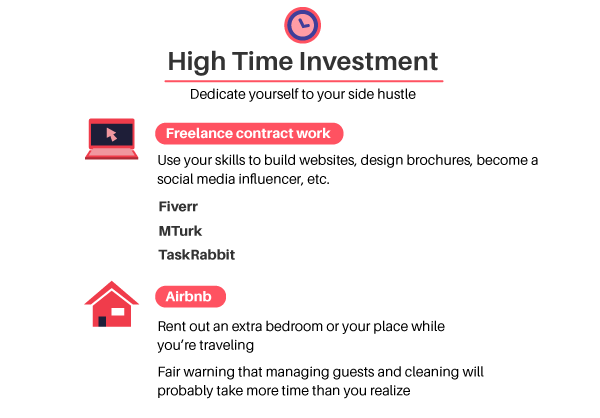

Get a side hustle! Consider using your car as an Uber between classes, sell stuff online or tutor via apps like Solvit, where you can earn $20/hour.

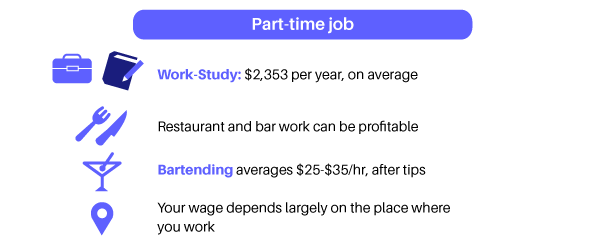

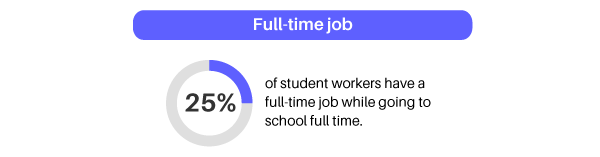

Or get an hourly job, like work-study or bartending. Twenty-five percent of students report working full-time.

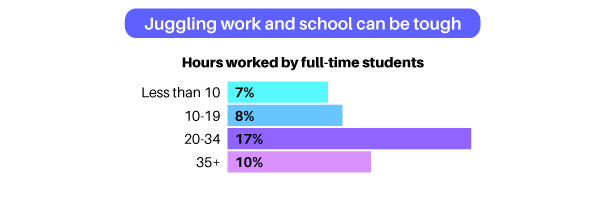

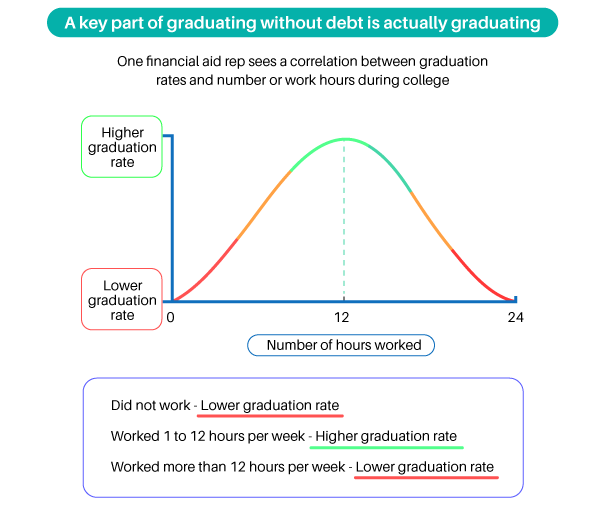

However, students who either work zero hours or work more than 14 hours have a lower graduation rate. It seems about 10-13 hours a week is optimum.

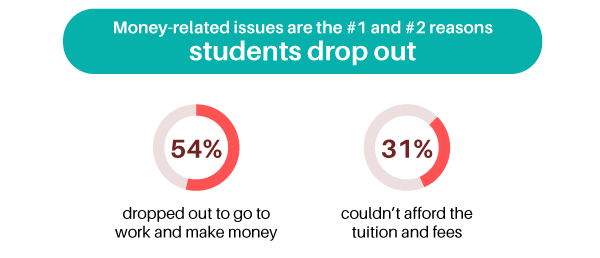

Don’t drop out. Fifty-four percent of students say they drop out to earn more money working, as opposed to 31 percent who say they can’t afford the tuition and fees. But over a lifetime, that degree will be worth a lot more than what you’re earning now!

Thanks to OneClass for this info. Visit them at oneclass.com.

Facebook Comments